Jun. 29 ? Income tax in India is a tax paid to the central government on personal income. It is the direct tax paid on income by an individual or a company/firm within a given financial year. The Indian Income Tax Department is governed by the Central Board for Direct Taxes and is part of the Department of Revenue under the Ministry of Finance.

Individual income tax (IIT) in India is based on resident-status and the source of the income. Residents are taxed on their global income whereas non-residents are only taxed on their income that is sourced, received, or accrued in India. Work done in India, regardless of the employer?s international status, will be taxed. As residency determines the tax rate, it is important to understand how resident status is itself determined. This is not wildly complicated, just intricate.

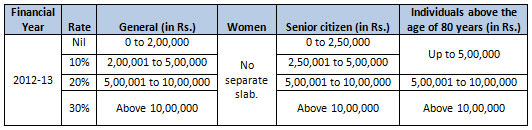

The tax liability to be computed for FY 2012-2013 is as follows:

The tax filing date for the financial year 2011-12 is July 31, 2012. Returns can be filed after July 31, 2012 but before the relevant assessment year (March 31, 2013), however it is advisable to file the tax returns by the due date.

All taxes should be filed by the due date. Any failure in filing the taxes will attract an interest rate of 1 percent per month. The interest rate will increase for default in the payment of advance tax.

Advantages of filing the taxes before due date

If the return is filed after the due date, then losses under the section ?Profits and Gains of Business or Profession? (other than depreciation loss) cannot be carried forward. Though, the payer can still save the losses against the income (other than income under the head salary) under other heads of the same year. The same procedure also applies for short and long term capital loss from sale of shares.

Therefore, if an individual files a tax by the due date of July 31, 2012, the short and long term capital loss from sale of shares can be carried forward and set off against capital gains or business profits, which could arise in the next eight years.

Tax return revision

Returns which are filed after the due date cannot be revised and considered as belated returns. As per the rules, belated tax filing is permitted within one year from the end of the evaluation year or completion of assessment, whichever is previous. However, the payer will have to decline the right to carry forward the losses or revise the return. For all those cases, a candidate can file a return with the due date and then revise it with actual details, subject to certain conditions.

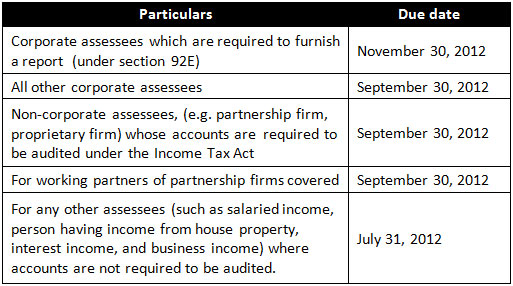

The timelines for filing up of tax returns are as follow:

Dezan Shira & Associates can assist with accounting in India, including:

- General Bookkeeping

- Accounting System Setup and Training

- Accounting Maintenance

- Annual Compliance Services

- Tax Reporting

- Financial Report Reconciliation

- Treasury and Fund Administration

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia?s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email india@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across India by subscribing to The India Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Income Tax Returns in India

India?s New Tax Structure for the Year 2012-13

Source: http://www.india-briefing.com/news/individual-income-tax-india-5488.html/

nascar bristol narwhal st louis university mario manningham mario manningham williams syndrome hoya

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.